Income Tax Rate 2017

Notable individual income tax changes in 2017.

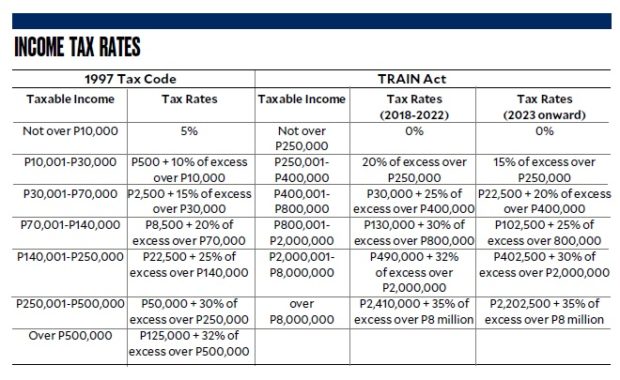

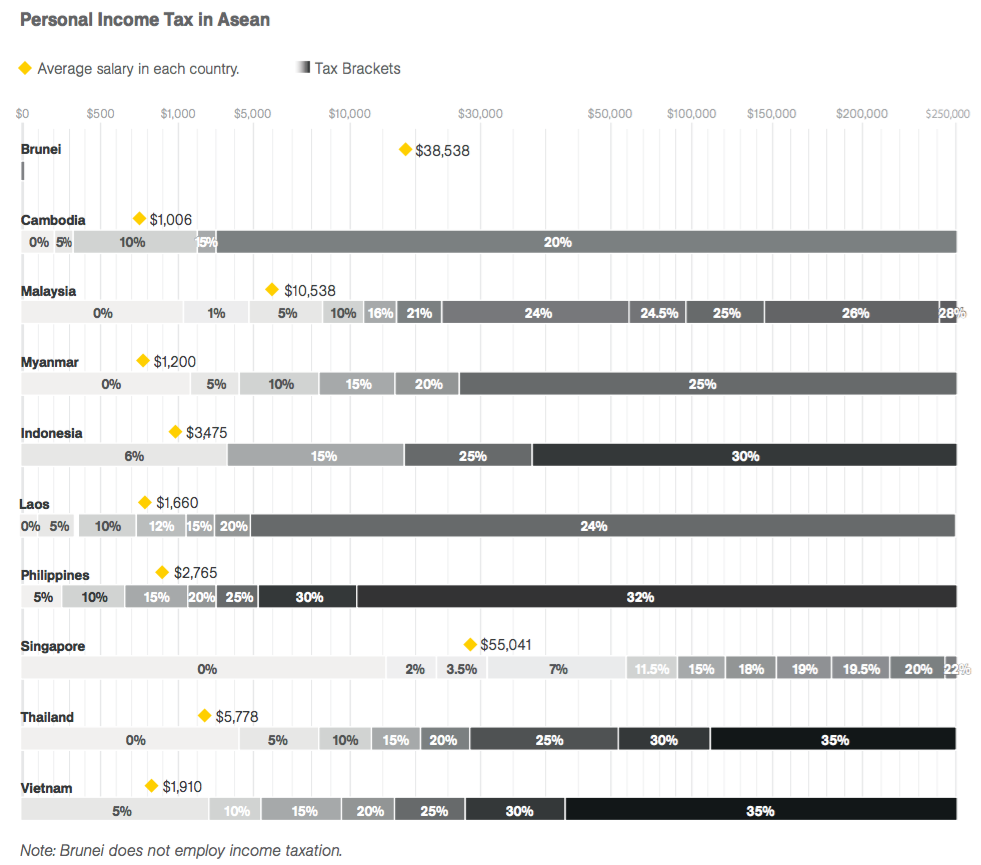

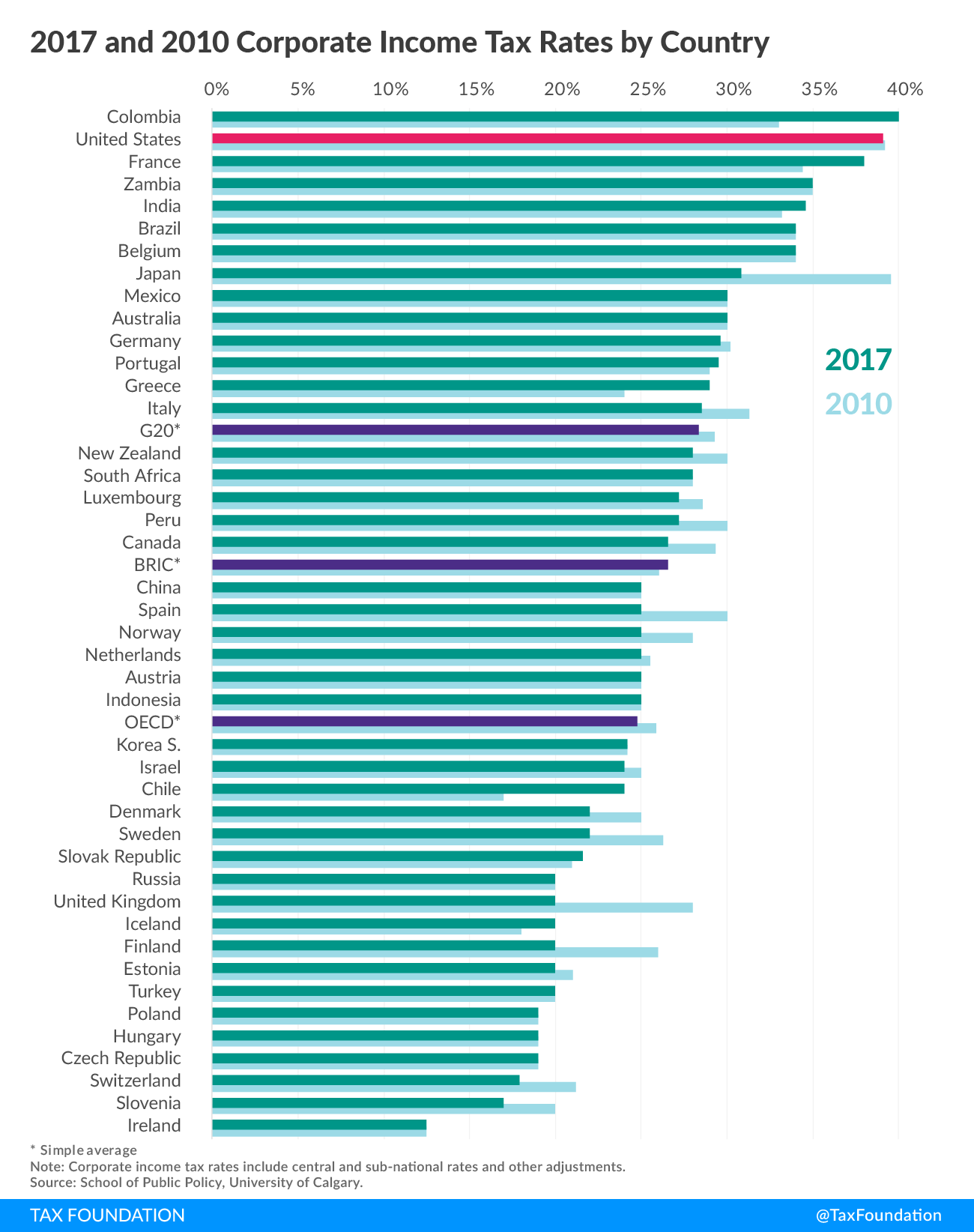

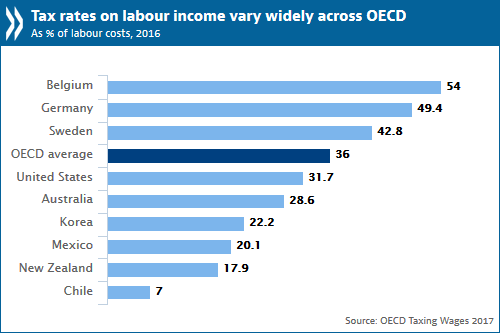

Income tax rate 2017. Apply to non dividend income including income from savings employment property or pensions. Working holiday maker tax rates 2020 21. The top marginal income tax rate of 39 6 percent will hit taxpayers with taxable income of 418 400 and higher for single filers and 470 700 and higher for married couples filing jointly. The federal income tax has 7 brackets.

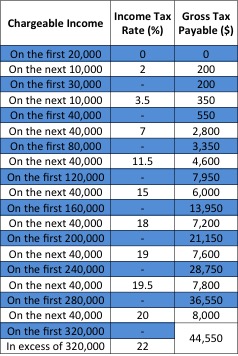

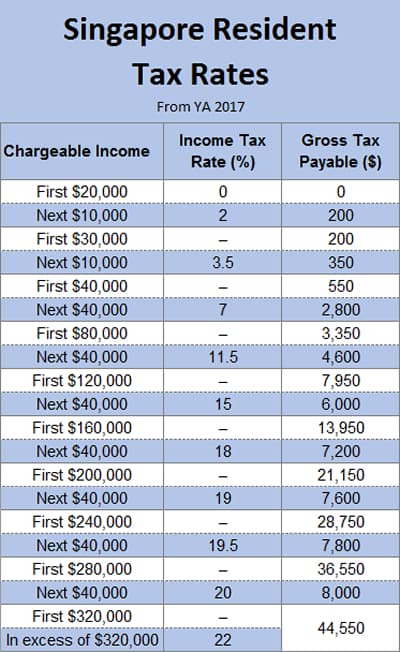

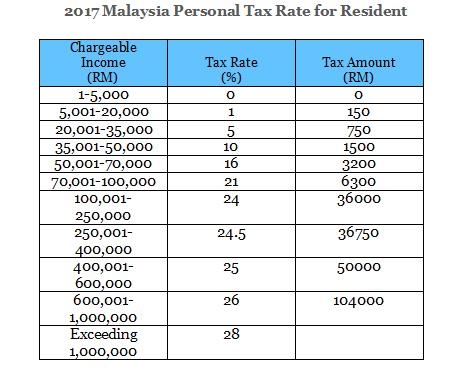

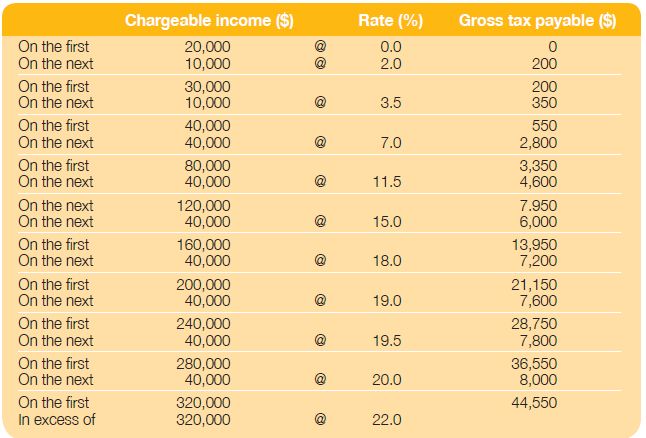

The lower tax rates are levied at the income brackets below. Several states changed key features of their individual income tax codes between 2016 and 2017. Calculating your income tax gives more information on how these work. On the first 2 500.

56 075 plus 45c for each 1 over 180 000. North carolina reduced its income tax rate from 5 75 to 5 499 percent as part of a broader tax reform package. Single taxable income tax brackets and rates 2017. It s important to understand that moving into a higher tax bracket does not mean that all of your income will be taxed at a higher rate.

Over 37 000 the normal non resident tax rates starting at 32 5 apply. Backpacker tax update 2 december 2016 from 1 january 2017 temporary working holiday makers will be taxed at a the rate of 15 for incomes up to 37 000. On the first 5 000 next 15 000. 22 775 plus 37c for each 1 over 90 000.

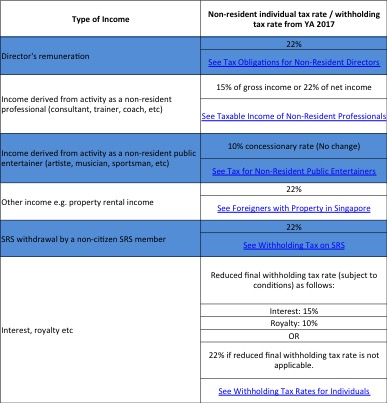

10 15 25 28 33 35 and 39 6. Taxes on director s fee consultation fees and all other income. 15c for each 1. Tax on this income.

The amount of tax you owe depends on your income level and filing status. This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals. Calculations rm rate tax rm 0 5 000. Tax rates bands and reliefs the following tables show the tax rates rate bands and tax reliefs for the tax year 2020 and the previous tax years.

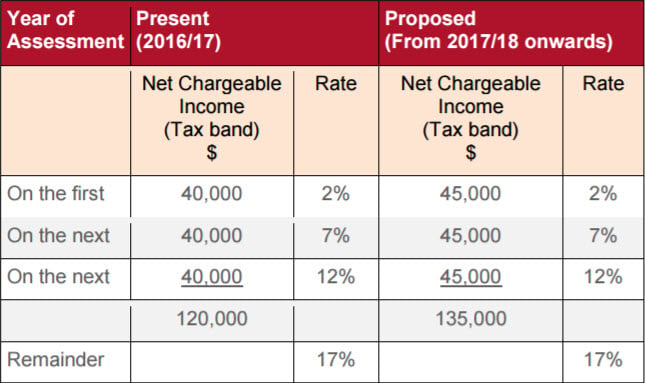

From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22. 5 550 plus 32 5c for each 1 over 37 000. Indiana reduced its individual income tax rate from 3 3 to 3 23 percent.